Corporations > Fees > Notices

Important Notices for Vermont Businesses

November 22, 2024 - Business Filing System Upgrade

We sent an email to all active registered businesses in our system today, 11/22, giving notice about an upcoming upgrade to our Online Business Filing System. We used an email campaign software; the email is legitimate. You can read it here: Our Online Business Filing System is Changing

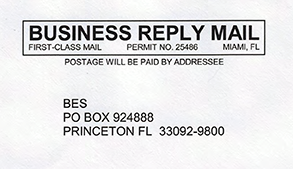

July 15, 2024 - BES Solicitation Notice

Attention Vermont Businesses - Please note that this solicitation is NOT from the Vermont Secretary of State - it comes from a private entity that is offering services for an additional filing service fee, which is not required by the State. While you may hire an agent to manage your business filings, it is not required and you may file reports and perform other tasks conveniently on our website. As a courtesy, the Secretary of State sends out a reminder notice when an annual or biennial report is due. You may file your report here: Annual/Biennial Report Filing (vermont.gov). If you ever have questions about a filing requirement, or receive a solicitation you think is suspicious, you are always welcome to contact us at SOS.CorporationsSupport@vermont.gov or 1-888-647-4582.

New Federal Reporting Requirement – Corporate Transparency Act

On Jan. 1, 2024, the Corporate Transparency Act (CTA), as recently passed by the United States Congress to combat money laundering and terrorist financing, goes into effect.

What this means to you:

This act creates an additional Federal reporting requirement regarding Beneficial Ownership Information (BOI) for many corporations, LLCs, and other similar entities created or registered to do business in the United States.

More Information:

To see if, when, and how this new requirement may apply to your entity, please see https://www.fincen.gov/boi or call the Financial Crimes Enforcement Network (FinCEN) - a bureau of the U.S. Dept. of the Treasury - at (800) 767-2825.

(Please do not contact the Vt. Secretary of State on this subject as we will only be able to provide the website and phone number above).

Contact Information

Business Services Division

128 State Street

Montpelier, VT 05633

802-828-2386

888-647-4582 (toll free)

Hours

7:45 AM to 4:30 PM

Monday - Friday (except holidays)